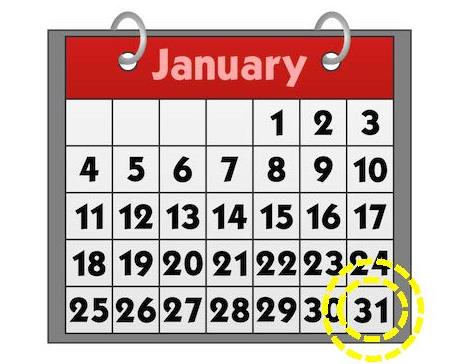

Starting in tax year 2016, the deadline for filing Forms W-2 and 1099-MISC (when reporting non-employee compensation in box 7) will now be January 31, 2017. This is a month earlier than the previous deadline date of February 28. This new deadline is for all employer Forms W-2 and 1099-MISC returns, both electronic and paper returns. The 2016 employer Forms W2 and 1099-MISC (when reporting non-employee compensation in box 7) filing deadline is Tuesday, January 31, 2017.

Starting in tax year 2016, the deadline for filing Forms W-2 and 1099-MISC (when reporting non-employee compensation in box 7) will now be January 31, 2017. This is a month earlier than the previous deadline date of February 28. This new deadline is for all employer Forms W-2 and 1099-MISC returns, both electronic and paper returns. The 2016 employer Forms W2 and 1099-MISC (when reporting non-employee compensation in box 7) filing deadline is Tuesday, January 31, 2017.

The changes were made in an effort to reduce fraud and ID theft, a provision in the Protecting Americans from Tax Hikes Act of 2015 which changed the filing deadlines for employer copies of forms W-2 and 1099-MISC. The earlier filing date gives the IRS more time to identify fraudulent returns, so that it can correct any issues before refunds go out.